|

|

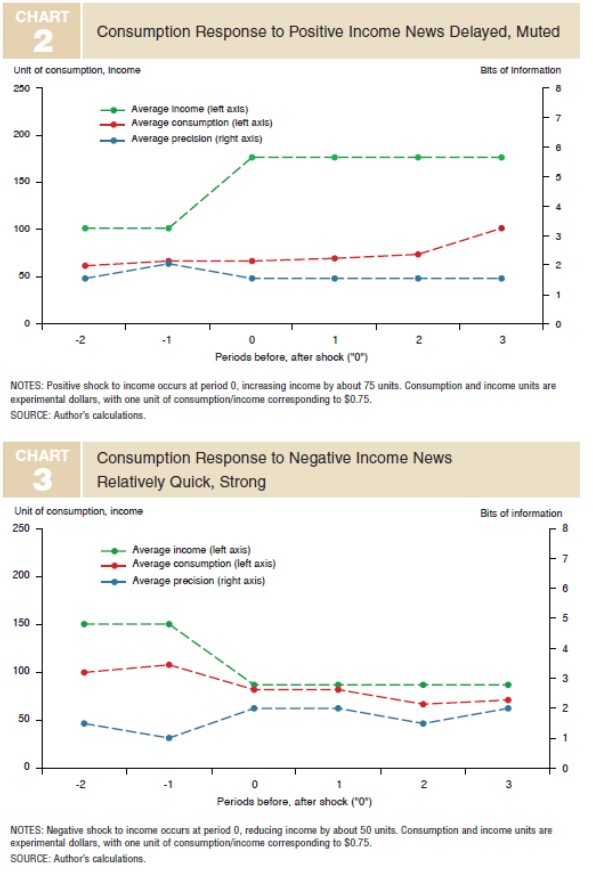

| Consumers Response More to negative News than Positive Info |

"The laboratory provides insight into how cognitively taxing it can become for people exposed to changes in the economic landscape to acquire and process information."

|

|

Abstract

Consumers, forced to navigate a constant stream of economic information, are often challenged to sort through details and respond to new material. Experiments suggest that people react more forcefully to negative income shocks than to positive ones. Size also matters: Reaction to small shocks is slower relative to the response to big shocks.

Text Excerpt:

"The laboratory provides insight into how cognitively taxing it can become for people exposed to changes in the economic landscape to acquire and process information."

Charts Excerpt:

|

Federal Reserve Bank of Dallas, Economic Letter, Volume 13, Number 7, May 2018-Antonella Tutino

31.08.2018

|

|

|

|

|

|

Themes

Asia

Bonds

Bubbles and Crashes

Business Cycles

Central Banks

China

Commodities

Contrarian

Corporates

Creative Destruction

Credit Crunch

Currencies

Current Account

Deflation

Depression

Equity

Europe

Financial Crisis

Fiscal Policy

Germany

Gloom and Doom

Gold

Government Debt

Historical Patterns

Household Debt

Inflation

Interest Rates

Japan

Market Timing

Misperceptions

Monetary Policy

Oil

Panics

Permabears

PIIGS

Predictions

Productivity

Real Estate

Seasonality

Sovereign Bonds

Systemic Risk

Switzerland

Tail Risk

Technology

Tipping Point

Trade Balance

U.S.A.

Uncertainty

Valuations

Yield

|