|

Rather than halting this bull, we think slowdown fears have helped it grind higher—and likely keep doing so this year as reality generally exceeds overly dour expectations.

A host of headlines declare 2019 will be a year to forget for the global economy:

- “Global Economic Slowdown Looms, Exposing Outgunned Central Banks”[i]

- “Global Markets Take Fright as Fears of a Slowdown Intensify”[ii]

- “A Growing List of Companies From FedEx to BMW Are Warning About the World Economy”[iii]

- “Global Slowdown Is Becoming More Intense—and No One Knows Why”[iv]

Supranational organizations like the IMF, OECD and ECB have also chimed in by cutting growth forecasts, citing risks like tariffs, European export weakness, soft Chinese demand and a potential no-deal Brexit. If the world economy is headed for some rough terrain, the argument goes, stocks will surely follow suit. But we see some holes in this logic.

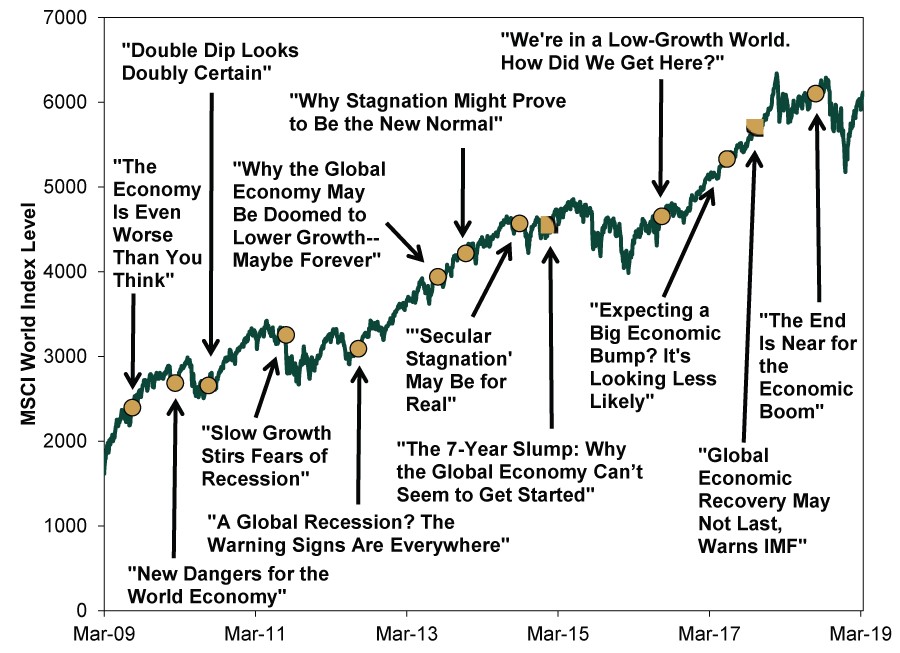

For starters, surprises move stocks most—and these fears aren’t new. Growth during this expansion has been relatively slow, fueling recurring worries about the economy’s health. In the financial crisis’s aftermath, many fretted the recovery would be L-shaped, or a double-dip recession awaited, or growth would stall and never reach “escape velocity,” or unresolved crisis-era issues would soon resurface, or once this or that artificial sugar high was past, a grim economic reality would reassert itself. Later, folks turned to bemoaning “secular stagnation”—a theory arguing growth would be permanently lower than its historical average. Most presumed slower growth, however we got it, carried dire implications for stocks. Meanwhile, overall and on average, global markets rose. (Exhibit 1) If anything, we think all the handwringing has helped prolong the bull by delaying the euphoria typifying market peaks.

Exhibit 1: Global Stocks Rise Despite Slow Growth Worries

Source: FactSet, as of 3/21/2019. MSCI World Index with net dividends, 3/9/2009 – 3/20/2019.[v] There are dozens and dozens and dozens more headlines we could have included, but we are told white space is good and it is already sparse here.

In our view, Exhibit 1 also illustrates why staying disciplined can be so difficult for investors. Despite rising 277% from the bull’s start to date, global stocks have endured plenty of volatility along the way—including 8 corrections (short, steep, sentiment-driven drops typically not exceeding -20%).[vi] In conjunction with a drumbeat of headlines bemoaning slow growth, this likely spooked many. Yet seeking shelter outside of stocks could have meant missing a big chunk of this bull market—especially since we don’t recall hearing an all-clear signal announcing the global economy was on firm footing at last.

We see several takeaways for investors. First, stocks don’t need gangbusters growth to rise. Rather, they move on the gap between reality and expectations. Slow growth beating expectations for even slower growth or contraction qualifies as a positive surprise—fuel for stocks. Dour forecasts of weakness ahead aid this process by lowering the bar for reality to clear.

Second, while people fixate on GDP, it doesn’t measure the same thing as stocks. The latter reflect investors’ expectations for publicly traded companies’ future earnings. GDP, on the other hand, is a rough estimate of a country’s economic output during a given time period, including the private and public sectors—quite different and inherently backward-looking. By the time it emerges, efficient markets have moved on to assessing corporate fundamentals over the next 3 – 30 months or so.

Moreover, economics isn’t the only thing driving stocks. Politics and sentiment matter, too. Modest growth, low political risk and not-too-hot expectations are a bullish recipe—and a pretty good reflection of where we stand today, in our view. Presently, investors fixate on trouble spots and recession risks. While both exist (as they nearly always do), we see positive fundamentals, too—like gridlocked governments around the developed world, a positively sloped global yield curve supporting lending and money supply growth, Chinese stimulus gradually kicking in (with likely global implications) and solid corporate revenues. These get little attention, however—evidence of sentiment’s low ebb. Hence, we think this bull market probably persists a while longer even if growth doesn’t surge.

[i] David J. Lynch, The Washington Post, 3/7/2019.

[ii] Katie Martin, The Financial Times, 3/22/2019.

[iii] Kate Rooney, CNBC, 3/20/2019.

[iv] Stephen Bartholomeusz, The Sydney Morning Herald, 3/19/2019.

[v] Sources, in chronological order: Mortimer Zuckerman, The Wall Street Journal, 7/14/2009; Staff, The Economist, 2/11/2010; Robert Murphy, MarketWatch, 7/20/2010; Conor Dougherty, The Wall Street Journal, 7/30/2011; Larry Kudlow, CNBC, 6/14/2012; Simone Foxman, Quartz, 8/1/2013; Lawrence Summers, The Financial Times, 12/15/2013; William A. Galston, The Wall Street Journal, 8/26/2014; David Parkinson, Richard Blackwell and Iain Marlow, The Globe and Mail, 1/23/2015; Neil Irwin, The New York Times, 8/7/2016; Nelson D. Schwartz, The New York Times, 5/26/2017; Larry Elliott, The Guardian, 10/10/2017; Geoff Colvin, Fortune, 7/19/2018.

[vi] Source: FactSet, as of 3/21/2019. MSCI World Index returns with net dividends, 3/9/2009 – 3/20/2019.

|