|

Let’s back up. Three months ago this week, the Swiss National Bank (SNB) issued this statement:

The Swiss National Bank (SNB) is discontinuing the minimum exchange rate of CHF 1.20 per euro.

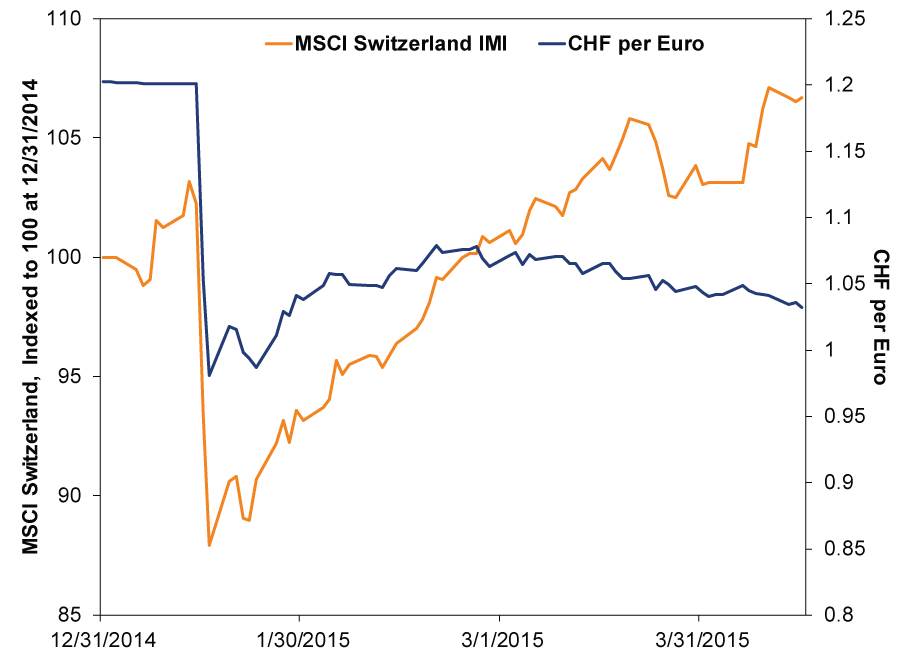

It went on to say some other stuff, but that seemingly mild-mannered comment convulsed Swiss markets and triggered a media feeding frenzy. The SNB long defended the minimum exchange rate—the floor—as a key policy plank. In the two days following the announcement—January 15 and 16—the franc surged 18% and 16% against the euro and dollar, respectively.[i] The MSCI Switzerland Investible Market Index (IMI, a gauge covering 99% of Swiss market capitalization) fell -14%.[ii] Several small foreign exchange brokerages failed. The media went into overdrive—how would export-driven businesses survive? Was it a Lehman moment?[iii] Would deflation set in and wreak havoc? In our view, this was always overwrought. Now, it’s premature to gauge who’s right or wrong here, but with the passage of a few months, we can at least peek at some data and check in.

Here is that peek, using the MSCI Switzerland IMI and Swiss franc year to date.

Exhibit 1: MSCI Switzerland IMI and Swiss Franc in 2015

Source: Factset, as of 4/16/2015. MSCI Switzerland IMI total return in Swiss francs.

Swiss stocks fell sharply but rebounded sharply, too—and here, three months since the exchange floor was deleted, they’re higher. The super steep outset notwithstanding, it has a classic correction look. It was short, sharp and surrounded by scary headlines. And unpredictable, unless you wiretapped SNB President Thomas Jordan’s phone.

The bounceback is broad-based, too—this isn’t a function of one industry or firm booming while others sag. Only one sector is down year-to-date (Consumer Discretionary, at -2.9%), and it has rebounded by more than 21% since the correction low. All the others are up, to varying degrees, with Switzerland’s big Financials sector rising 9.6% on the year and 29.4% since the low.[iv]

Economically, data rolling in from Switzerland since the currency floor was deleted are limited. GDP will likely show some impact, though we’d caution against overrating it. The Swiss Federal Statistics Office projects GDP will slow some tied to cooler export growth, although that is merely an estimate from March—and being the official estimate, chances are stocks are aware of it. CPI was negative on a monthly basis in January and February, but it swung positive in March (+0.3% m/m). Not to mention, inflation was negative on an annual basis for 2012, 2013 and 2014, yet GDP grew all along, so this shouldn’t be automatically concerning, contrary to some pundits’ arguments. Maybe growth slows from here, but markets aren’t suggesting big problems loom.

Which may actually add a bit of perspective to fears the strong dollar and pound will hit US and UK markets. Now, there are a host of reasons these fears are overrated,[v] but perhaps the Swiss experience can add another. Consider: Swiss exports constituted 72.1% of GDP in 2013, according to the World Bank. US exports were 13.5% of GDP. UK? 29.8%. If Swiss markets, then, haven’t been sideswiped by a sudden currency spike, why should larger, more diverse, more domestic-oriented economies fare worse? Wouldn’t they be more likely to prove even more resilient?

Look, we realize comparing three economies that are so different is not an exact science. No comparison is. But what is true is that around the world, markets have shown time and again their ability to adapt to even sudden and sharp changes is too often overlooked by the media. It is generally only the biggest surprises, multi-trillion dollar sucker punches, that have a lasting impact.

[i] Source: Factset, as of 4/16/2015.

[ii] Source: Factset, as of 4/16/2015. MSCI Switzerland IMI total return (in Swiss francs) for the period 1/14/2015 – 1/16/2015.

[iii] As we wrote the other day, we are mystified by the notion a currency can have a Lehman moment, as they cannot go bankrupt. But we digress.

[iv] Source: Factset, as of 04/16/2015. All figures are in Swiss francs and use the MSCI Switzerland IMI sector indexes

[v] Here are three:

1. All markets discount information near simultaneously, so currency moves are likely already reflected in stocks (See the chart and the near simultaneous move down as the franc strengthened.)

2. Multinational firms have costs as well as revenues in foreign currencies. Strong currencies reduce foreign-sourced input costs.

3. Exports are likely only impacted on the margin by these kinds of moves.

Source: MarketMinder

|