|

Monty Python had a classic "Olympic Hide and Seek Final" in which the first seeker took 3 years, 27 days, 11 hours and 42.23 seconds to find the first hider. Then they reversed roles, did it again, and the result was…a tie.

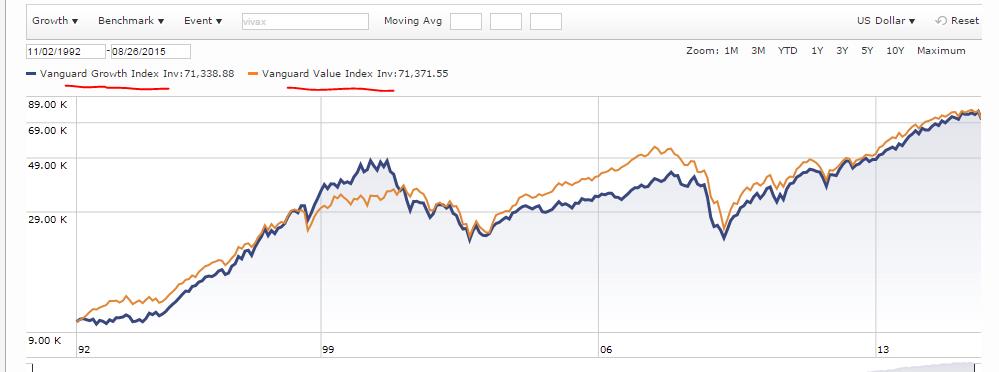

Similarly for "value" and "growth" over the 23-year lifespans of the Vanguard "Growth" and "Value" index funds.

Vanguard Growth Index vs. Value: 02/11/1992 - 26/08/2015

anonymous writes:

The feud has been going on for far longer. In 1970s, Nifty Fifty stocks claimed victory with an average P/E of 42, and then crashed by 1974. It looked like growth was a bubble and has lost. Twenty years later, Siegal claimed victory for growth. As long as one diversified and got Walmart in the portfolio, it turns out that Nifty actually did OK.

The next 20 years as your graph suggests shows the Dot-Com and Biotech booms for growth.

|