|

Excerpt from the full report:

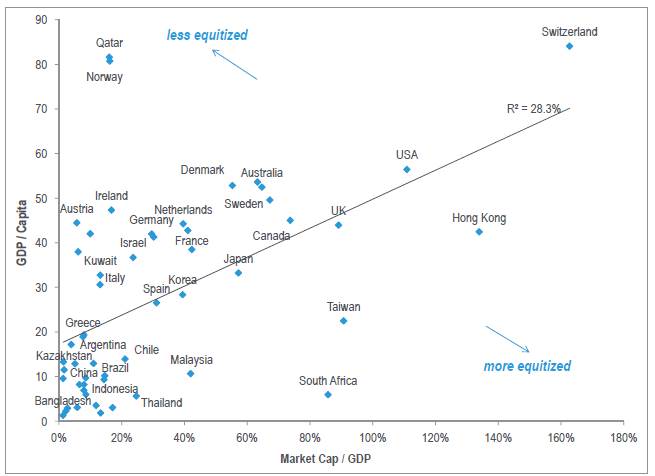

"A scatterplot of 53 countries (Figure 7) plots equitization (market capitalization-to-GDP) against wealth (GDP-per-capita) and shows a clear relationship between the two. Here we see that the world’s richest country (Switzerland) also has one of its largest equity markets (160% of GDP). Poor countries such as Bangladesh, Nigeria and Vietnam have much smaller equity markets (< 10% of GDP)."

Figure 7. Market Cap/GDP and GDP/Capita for the World’s 53 Largest Economies in 2014

Source: Haver Analytics Citi Research

"Of course, there are outliers. South Africa has a considerably larger equity market (80% of GDP) than its income level would seem to justify. Conversely, Qatar and Norway look undersized in equity terms, relative to their wealthy populations. In all three cases, these deviations are driven by privatization policy towards natural resources: South Africa’s miners are largely listed (and have significant overseas assets), while the energy sector in Norway and Qatar remains in state hands. Other outliers include Ireland and Austria, whose equity markets were both laid low by the financial crisis of 2008, which led to the renationalization of some listed banks. China is one to watch: in our chart, it looks in-line with other markets of its income level (8% market cap), but that is because MSCI currently excludes the local Ashare market due to restrictions on foreign investment. As these shares become more investable and are eventually included by MSCI, as seems likely, China’s market cap/GDP will rise substantially."

|