|

†

Interesting that so few money managers have come even close to match such a performance. Does it have anything to do with the cycles, the clients-behaviour, poor market timing instead of regular re-balancing, too many shifts in strategy at the worst of times?

On the other hand, maybe†we are the new shoe-shine boys; has the time finally come for this strategy to stop working, through a poor performance of bonds and/or equity over multiple decades? Time will tell.

†

Balanced Portfolio Strategies since 1995

Click on the chart for a larger view

Source: Lipper

†

25% MSCI World

75% Citigroup WGBI (World Government Bond Index)

†

50% MSCI World

50% Citigroup WGBI

†

75% MSCI World

25% Citigroup WGBI

†

†

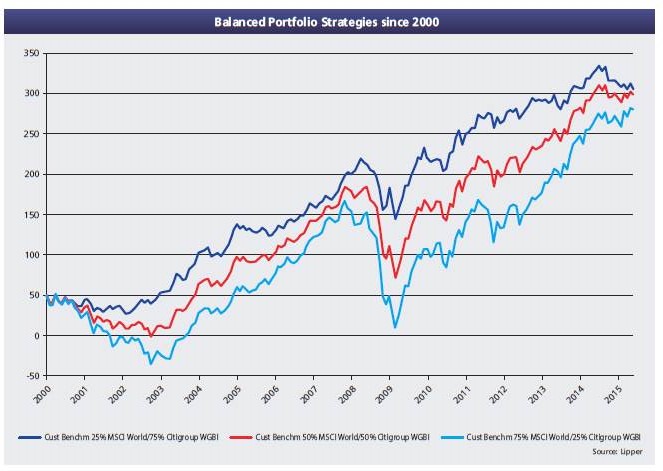

Balanced Portfolio Strategies since 2000

Click on the chart for a larger view

Source: Lipper

†

25% MSCI World

75% Citigroup WGBI (World Government Bond Index)

†

50% MSCI World

50% Citigroup WGBI

†

75% MSCI World

25% Citigroup WGBI

†

†

†

†

†

† |