|

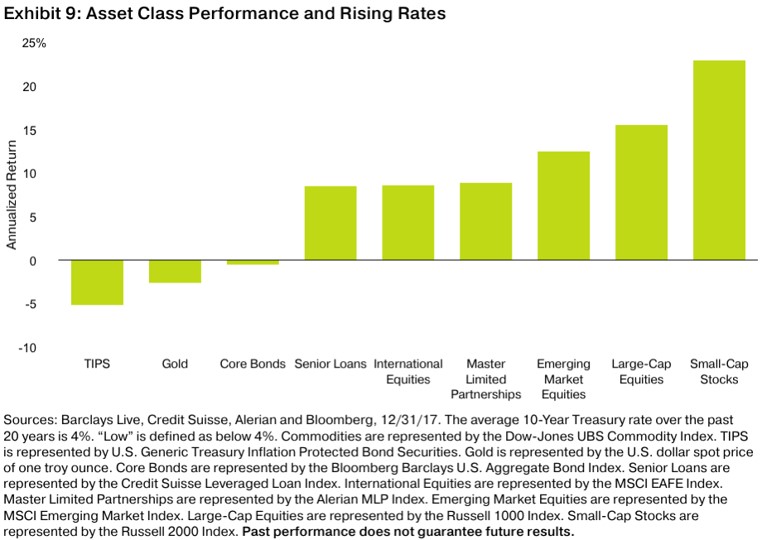

Rising long-term interest rates historically have been beneficial to most asset classes. Rate increases typically coincide with improvements in economic activity, benefiting equities and equity-like assets globally as well as credit.

For now, investor concern about trade and Fed policy limit the likelihood of a significant rotation into emerging market equities. However, emerging market growth prospects are likely to improve relative to the U.S. over the intermediate term as the Fed tightens conditions and China and India continue with more stimulative monetary policy. That will ultimately favor emerging markets over domestically focused U.S. companies, particularly given current relative valuations.

This is an excerpt from the report "What Rising Rates Mean for the Markets and Investors. In our view, rising interest rates are unlikely to kill the bull market at this point."

|