|

A very interesting essay from John Williams, you can find herewith some excerpts and charts:

"It is often said that cash is king. But a quick glance at the register in stores and restaurants might make you think the king is on his deathbed."

...

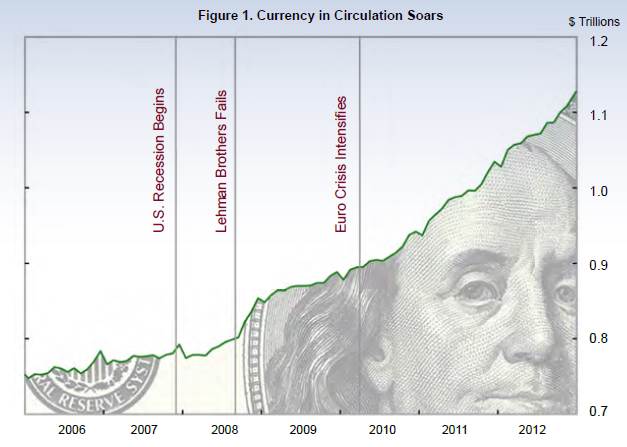

"Yet, to paraphrase Mark Twain, reports of the demise of cash are greatly exaggerated. In fact, they are plain wrong. It’s undeniable, of course, that alternative payment methods are growing rapidly and significantly increasing their market share. But cash lives on. The quantity of currency in the economy keeps growing. As Figure 1 shows, since the start of the recession in December 2007 and throughout the recovery, the value of U. S. currency in circulation has risen dramatically. It is now fully 42% higher than it was five years ago."

Currency in Circulation: 2006 - 2012

Source: Federal Reserve Bank of San Francisco

"Why are holdings of currency soaring at the same time that Americans appear to be turning away from using cash to pay for purchases? To make sense of this paradox, it’s helpful to understand the reasons people hold cash in the first place. Economists have identified two basic reasons why people use currency. First, it is exceptionally convenient as a medium of exchange. Cash is easy to carry, it’s widely accepted, and it’s easy to divide for transactions of different sizes. Importantly, you can count on cash even when other payment methods might not be working, during power outages and natural disasters, for example. And cash has another advantage to users: It’s anonymous. Using cash keeps transactions away from the eyes of tax collectors, law enforcement agencies, and businesses that track the buying habits of individual Americans."

...

"The second reason to hold cash is that it serves as a store of value. Keeping a hoard of currency—whether under a mattress, in a safe, or in a safe deposit box—is often viewed as a low-risk way to hold financial assets. That’s especially so during periods of political or financial turmoil. For example, during the recent financial crisis, some people may have withdrawn cash from accounts at banks and other institutions because they were afraid these institutions might fail. Around the world, during periods of political unrest or war, cash—especially the currency of a stable country like the United States—is seen as a safe asset that can be spirited out of harm’s way with relative ease."

...

"Since the start of the U.S. recession in December 2007 and throughout the recovery, the value of U.S. currency in circulation has risen dramatically."

...

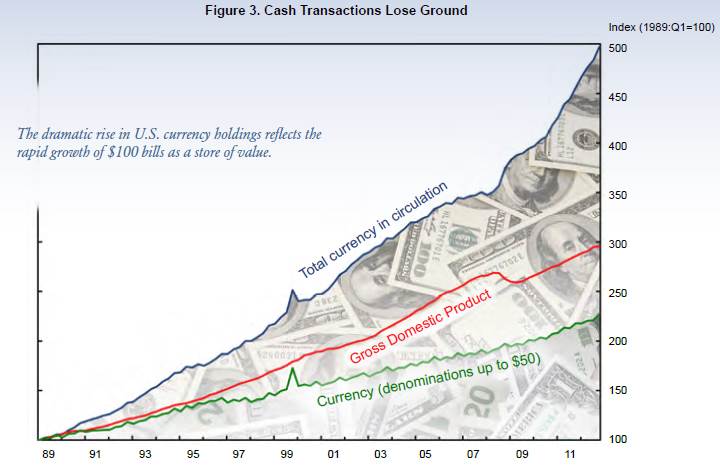

"But there’s evidence that, even though the amount of cash has continued to climb, the share of transactions using cash has fallen steadily in recent years."

...

"Despite the evidence that people are increasingly using other forms of payment, the amount of currency in circulation keeps piling up."

“. . . in the six months following

the fall of the investment bank

Lehman Brothers in 2008,

holdings of $100 bills soared by

$58 billion, a 10% jump.”

"But why would people hold so many more $100 bills now than before the recession? That brings us back to cash as a store of value. As fears about the safety of the banking system spread in late 2008, many people became terrified of losing their savings. Instead, they put their trust in cold, hard cash. Not surprisingly, as depositors socked away money to protect themselves against a financial collapse, they often sought $100 bills. Such a large denomination is easier to conceal or store in bulk than smaller bills. Indeed, in the six months following the fall of the investment bank Lehman Brothers in 2008, holdings of $100 bills soared by $58 billion, a 10% jump."

Total Currency in Circulation, GDP and Currency in Circulation up to USD 50:

2006 - 2012

Source: Federal Reserve Bank of San Francisco

"Meanwhile, when interest rates return to more-normal levels, the opportunity cost of holding cash will rise, which should cause currency demand to fall somewhat. But the $100 question is whether economic and political uncertainty will remain high. If uncertainty recedes, many people will probably take their $100 bills back to the banks. But if events in Europe or elsewhere around the globe stir more anxiety, appetite for U.S. dollars could surge anew."

|