|

Global CIO Commentary by Scott Minerd

I can’t recall in my career where I had such an accurate forecast on the economy, and then was so surprised by the market’s reaction. Weeks before first-quarter U.S. gross domestic product (GDP) was announced, we were forecasting extremely weak economic growth—near zero or even negative for the quarter. Market consensus was 1 percent, so the shock of just 0.2 percent GDP growth should have driven rates down. Since 2010, GDP disappointments like this have led 10-year Treasury yields to fall by 5.5 basis points on average in the two days following the release. This time around, the opposite occurred—yields rose by double that, and continued to rise.

Many have speculated about what caused this selloff because it was so out of line with what one would expect following a surprisingly weak GDP print. I think the reason had more to do with what was happening in Europe than what was going on in the U.S. economy. European bond market volatility has been extreme. The yield on the German bund has gone from a low of 8 basis points on April 20 to around 70 this week, a move of over 800 percent (by the way, if you purchased a bund at the bottom in yields, it would hypothetically take 65 years’ worth of yield to erase such losses). Violent convulsions like these are not based on fundamental changes but relate to technical factors resulting from market distortions created by quantitative easing and macroprudential policy. Similarly, the backup in U.S. rates is likely a result of market machinations. Call it a volatility overflow from Europe.

Ultimately, all of this unusual market behavior should prove to be just noise. We are likely to continue down the road we’ve been on, with a flood of liquidity coming into the system as foreign investors pursue relatively attractive yields in the United States. The reality though is that Europe cannot abort its quantitative easing program early. In fact, I expect the European Central Bank will soon confirm that it will stay the course until September 2016 as it seeks to calm the nerves of the market.

For the moment, given the rise in interest rates that we’ve had, the market has discounted a fair amount of risk and has repriced for that. On balance, we’re better positioned today in terms of value than we were two or three weeks ago. The risk-on trade remains intact, despite recent market irrationality, and the sensible reaction is to remain long equities and credit.

In equities, the old adage “Sell in May and go away” usually has a high statistical significance of working. This year, it may not. Since 1980, the average U.S. equity return through this point in the year is nearly 5 percent. So far, however, performance has been sluggish, with the market up just 3 percent. This may mean there is headroom for stocks heading into the summer months. This view is reinforced by the fact that stocks have historically performed well in the period leading up to the first Federal Reserve rate hike. The S&P 500 has historically gained on average more than 9 percent in the five months prior to tightening by the Fed, which I continue to believe will commence in September.

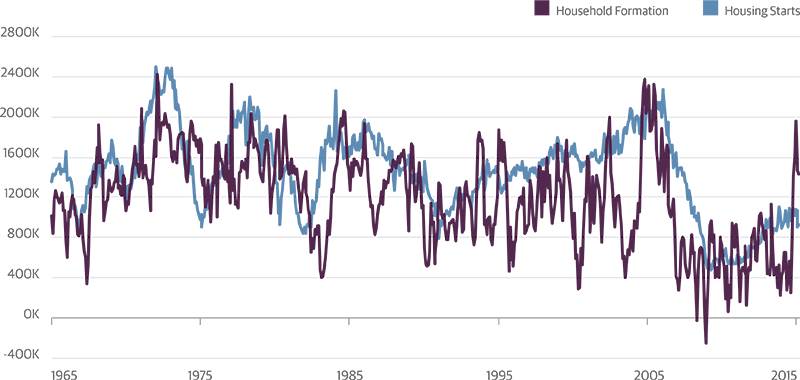

Household Formation and Housing Starts

Source: Haver, Guggenheim Investments. Household formation is defined as the one-year change in total number of households. Data as of 3/31/2015.

Original Report

|