|

There was this famous line from Orson Welles in the 1949's movie classic "The Third Man":

"You know what the fellow said – in Italy, for thirty years under the Borgias, they had warfare, terror, murder and bloodshed, but they produced Michelangelo, Leonardo da Vinci and the Renaissance. In Switzerland, they had brotherly love, they had five hundred years of democracy and peace – and what did that produce? The cuckoo clock."

Well, 60 years later, the Swiss National Bank might just be re-writing Switzerland's history, with a creation of its very own: the "all you can eat" EUR "pegg" !

Whereas the initial argument was all about defending exporters and some supposed "phantom" deflation, three years and some CHF 400 billion later, the unusual scale of these currency interventions (with a bizarre risk/return trade-off) have lost any commensurate relation with some hypothetical loss of "export competitiveness".

A theoretical 20% EUR/CHF correction (equivalent to the EUR/CHF rate at parity) would amount to a staggering amount of, hold your breadth, CHF 80 billion (yes, it's a "B"), or 15% of GDP! Does anyone seriously believe that Switzerland's export and service industry would have lost that much since 2008 because of the currency effect alone ? What if you subtract the "opportunity costs" for domestic consumers and corporates, whether in the form of cheaper imports or aquisitions/spending across Europe ?

A country that had (and in many ways still has) all the characteristics of political and economic strength, envied by its neighbours, has been painted into a corner by the very institution that was supposed to provide stability and credibility. The amateurism of the SNB's intervention is truly disconcerting, a big bluff gone awry !

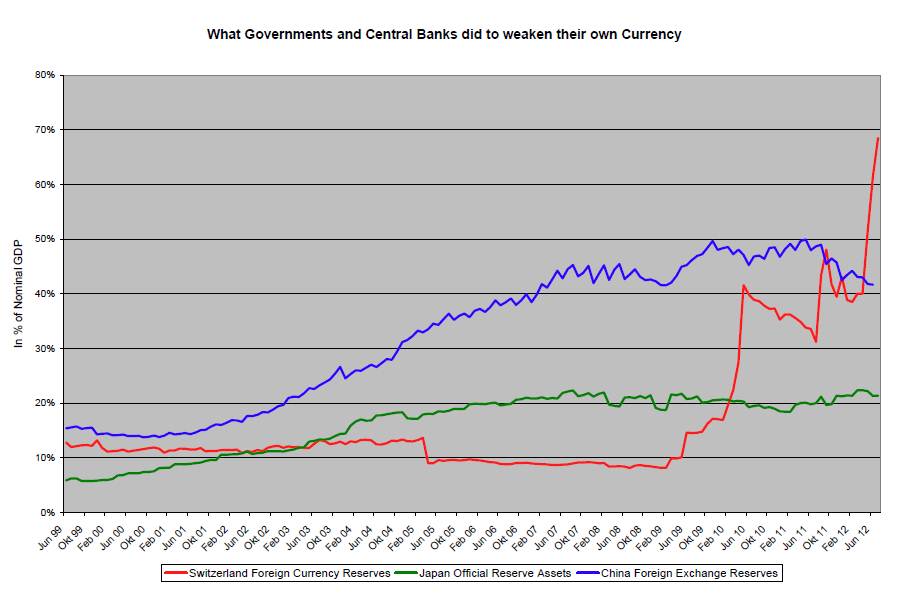

The SNB's foreign currency reserves (red line) stand close to 70% of GDP, compared with the central banks in China (blue line, around 40%) and the Bank of Japan (green line, above 20%):

Click on the picture for a higher resolution image

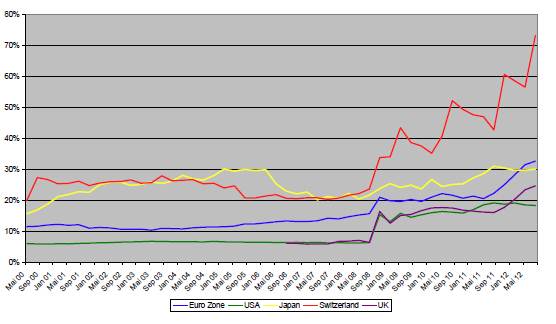

Total Assets of Central Banks compared to GDP: well above 70% for the SNB, followed by the ECB and the BoJ, both around 30%, while the Fed (green line) stands below 20%:

Click on the picture for a higher resolution image

|