|

Barton Biggs was probaly one of the finest mind on Wall Street. As an investment srategist, he had great respect for markets and their many pitfalls, and he never succumbed to the "doom and gloom" syndrom or to the "madness of crowds" trap.

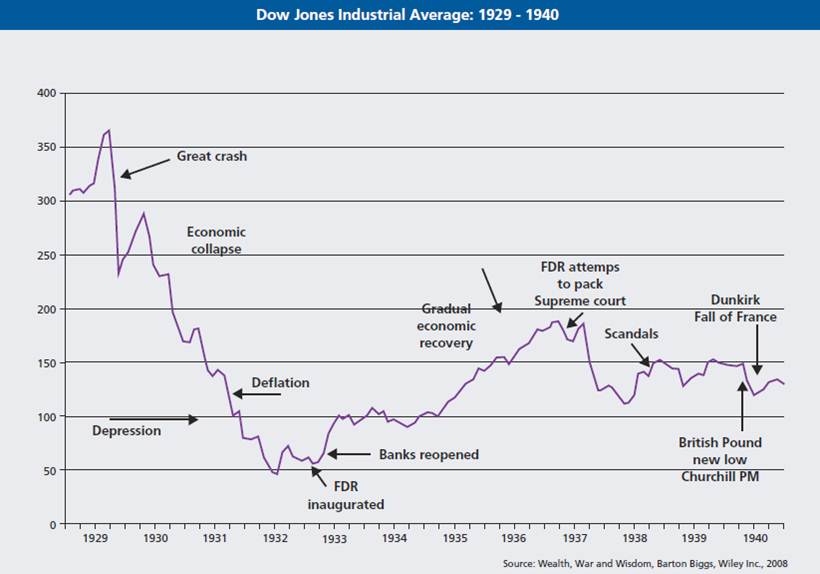

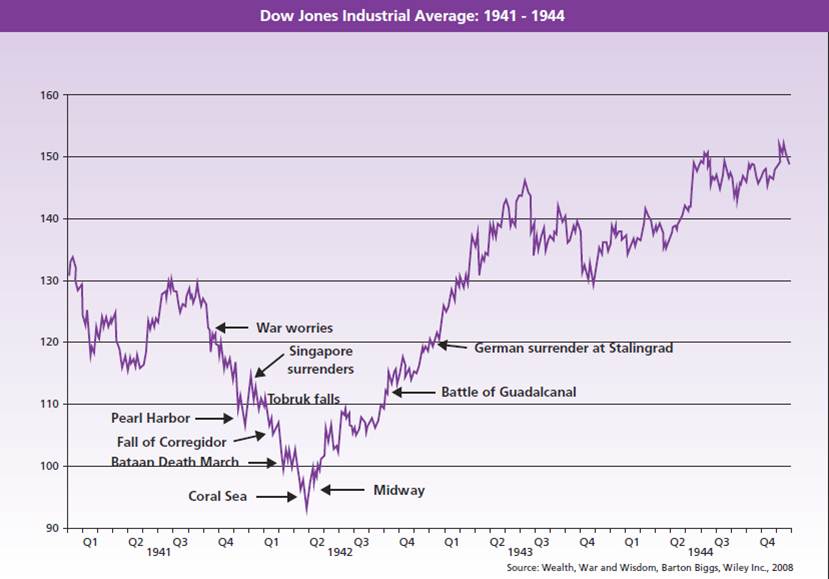

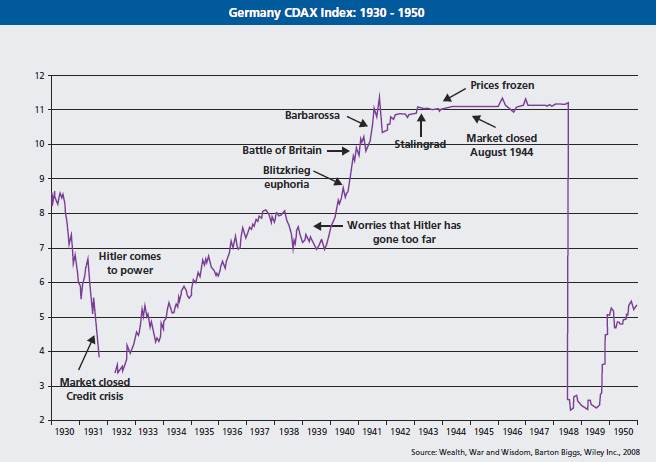

In his book "Wealth, War and Wisdom", Barton Biggs analyses equity markets behavior during the key events of World War II; and the results are truly fascinating, as you can see in the charts below:

Dow Jones Industrial Average: 1929 - 1940

You can click on the chart to view a larger version

Dow Jones Average: 1935 - 1950

You can click on the chart to view a larger version

Dow Jones Average: 1941 - 1944

You can click on the chart to view a larger version

Excerpts:

"Then in May 1942, just before the United States’ military fortunes in the Pacific improved, in the midst of the gloom and the bargains and at the point of maximum bearishness, the U.S. stock market made a bottom for the ages."

"In occupied Europe during World War II, all things considered, gold was the best asset to hide in, preserve wealth, and maintain some liquidity. Stocks, land, real estate, and businesses worked only if you had a very long-tern horizon. The black market was the most lucrative profession."

"It’s interesting how well the stock market performed after mid-October in spite of another avalanche of very bad war news (…) it must have sensed the rising odds of the United States being drawn into the war. Another example of the wisdom of markets. (…) The war news was consistently bad, but nevertheless stocks worked higher."

"(…) the U.S. stock market instinctively understood the significance of Midway, well before expert opinion or the conventional wisdom grasped its importance."

"(…) the bottom of a bear market by definition has to be the point of maximum bearishness, and from that point, the news doesn’t actually have to be good, it just has to be less bad than what has already been discounted in prices."

Germany CDAX Index: 1930 - 1950

You can click on the chart to view a larger version

"In late 1939, however, well ahead of the Blitzkrieg stock prices began to anticipate the overwhelming victories of 1940."

"By 1940 and throughout 1941 the German economy was booming from military production. (…) The interesting insight is that by the late fall of 1941, the Berlin market was somehow sensing that Hitler’s luck, his infallibility were fading and that Germany’s military momentum had crested. (…) Did anyone know the tide had turned except the stock market? Certainly a few of the generals suspected."

|