|

1) Checking Out: Exits from Currency Unions

Andrew Rose, 2007

Abstract

This paper studies the characteristics of departures from monetary unions. During the post-war period, almost seventy distinct countries or territories have left a currency union, while over sixty have remained continuously in currency unions. I compare countries leaving currency unions to those remaining within them, and find that leavers tend to be larger, richer, and more democratic; they also tend to have higher inflation. However, there are typically no sharp macroeconomic movements before, during, or after exits.

In this short paper, I examine the gross features of countries exiting currency unions. Since the end of the Second World War, 69 countries, territories, or other entities (hereafter “countries”) have left currency unions. I compare these countries to the 61 entities that remained continuously within currency unions during the same period of time. I find only a few macroeconomic differences between countries remaining in and leaving currency unions. Exiters tend to be larger, richer, and more democratic than stayers. But these differences tend to be persistent and sluggish; there are few dramatic macroeconomic events around currency union exits.

"Since World War II, 61 countries have continuously been members of currency union."

...

"But perhaps the most striking feature of the data is the absence of volatility. In general, there are remarkably few signs of dramatic macroeconomic events either preceding or following currency union dissolutions."

...

"I find that countries leaving currency unions tend to be larger, richer, and more democratic; they also tend to experience somewhat higher inflation. Most strikingly, there is remarkably little macroeconomic volatility around the time of currency union dissolutions, and only a poor linkage between monetary and political independence. Indeed, aggregate macroeconomic features of the economy do a poor job in predicting currency union exits. I conclude that there is plenty of room for future research in this area."

2) Have a Break, have a ...National Currency: When do Monetary Unions Fall Apart?

Volker Nitsch, Working Paper, January 2004

Abstract

Historically, dissolutions of currency unions are not unusual. I use an annual panel data set covering 245 country pairs that use a common currency (of which 128 are dissolved) from 1948 through 1997 to characterize currency union exits. I find that departures from a currency union tend to occur when there is a large inflation differential between member countries, when the currency union involves a country which is closed to international trade and trade flows dry up, and when there is a change in the political status of a member. In general, however, macroeconomic factors have only little predictive power for currency union dissolutions.

...

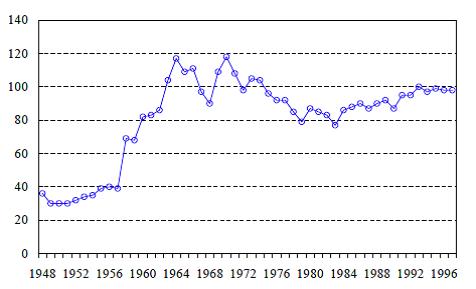

a) Number of (Currency Union) Observations

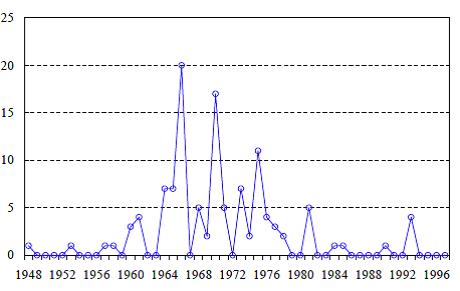

b) Number of Currency Union Dissolutions

|