|

|

The Coffee Chronicles

"So, how much do you want for this "priceless" item?"

Rick Harrison, Pawn Stars: Rare Boba Fett Action Figure Prototype, January 10, 2016

|

|

About the German economic mythology

On the subject of economic policy, some opinion makers in Germany peddle myths, i.e. imaginary tales without a factual basis aimed at pleasing the crowd. Read more...

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, 4 December 2019 |

Trade Rebound vs. USD Shortage

"The world has been suffering from a shortage of USD for 25 months in a row, which is the longest period ever, since the end of the Gold Standard in 1971. This might explain the USDs surprizing strength during the last two years and the fact that world trade has completely flattened over the period."

Didier Darcet, Gavekal Intelligence Software, The Quant Corner, December 2019

|

Sugar-Coated Diets: The Hidden Costs of Sugar

"The cost to society is reaching an unbearable level estimates suggest a full 1% to 2% of world GDP in health costs due to bad diets. The cost is both large, and at the moment, largely hidden." Read more...

Solange Le Jeune; Wim Van Hyfte, Candriam, May 2019 |

|

In search of a free lunch

Correlations between groups of assets and within individual asset classes have changed in unexpected ways thanks to a decade of easy monetary policy. Our portfolio managers tell us what impact this has had on the way they manage money. Read more...

Aviva Investors, Insight, 5 November 2019 |

|

Quote on

the Fly

|

"There is something vaguely troubling when the unthinkable becomes routine."

...on the acceptance of negative interest rates.

Claudio Borio, Monetary and Economic Department, BIS Quarterly Review, BIS, September 2019

|

|

(after discussing how Shichiroji managed to survive the last battle they fought together)

Kambei Shimada: As a matter of fact, I'm preparing for a tough war. It will bring us neither money nor fame. Want to join?

Shichiroji: Yes!

Quote from the Seven Samurai, Akira Kurosawa, 1954 |

The memory of stock return volatility: Asset pricing implications

Read more...

Duc Binh Benno Nguyen, Marcel Prokopczuk, Philipp Sibbertsen

Journal of Financial Markets, 23 January 2019

Direct-Drive Motor Company

Founded in 1917, Direct Drive Motor Car Company built automobiles under the brand Champion. The company plodded along until 1924 when it had to close its business. Interestingly, a hundred years later, this idea of direct drive was to become widely adopted by electric cars.

Read more... |

Currency Competition in Switzerland, 1826-1850

"Currency competition provided a stable monetary standard in those Swiss cantons that deregulated their financial systems after liberal revolutions in the 1830s and 40s."

Ernst Juerg Weber, Kyklos, August 1988

|

"Now imagine you dont see the conductor, you cant see the orchestra, you cant see the way the bow is moving, and you hear that! And that irritated many commentators, many critics, because whats going on, there is no pulse, there is no rythme, there is no

EXACTLY! Thats the point! Wagner is trying to create a sense of remoteness, musically, of place, of time, of remoteness that has nothing to do with our everyday world."

Antonio Pappano introduces the music of Parsifal (The Royal Opera), December 2013 |

The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

"It was never accounted for how that miracle wasnt all that miraculous; it was bought and paid for by an equally rapid advance in global eurodollars. Take away the dollars and the growth suddenly disappears. But thats not in the textbooks."

Jeffrey P. Snider, Alhambra Investment Partners, October 18th, 2019

Chinas Dollar Problem Puts the Sync In Globally Synchronized Downturn

"The PBOC cannot gain headway because, contrary to Western imagination, Chinese technocrats are not actually patient geniuses playing some hidden long game at the rest of the worlds expense. They are hanging on merely hoping something goes right."

Jeffrey P. Snider, Alhambra Investment Partners, October 16th, 2019

Financial Follies: Fiscal Stimulus and Modern Monetary Theory in the Era of Quantitative Easing and Zero or Negative Interest Rates

"Conventional economic wisdom is that monetary policy has done the heavy lifting in terms of reviving economic growth. Now that policy rates are low or negative and balance sheets have expanded, all we need is some fiscal stimulus to keep an economy from turning down into recession."

Gerhardt (Gary) P. Herbert, Brandywine Global, Around the Curve, October 7 2019

10 Year Treasury Yields at Zero, and Why Fiscal Stimulus and Modern Monetary Theory are Financial Follies

Those of us of a certain age can remember watching Saturday afternoon black and white reruns of Laurel and Hardy films. Invariably, after a series of laughable misunderstandings and comic mistakes Hardy would lament to sidekick Laurel, Well, heres another nice mess youve gotten me into! Well, todays Federal Reserve (Fed) reminds me of the well-meaning, but often bumbling Laurel, while pompous and stubborn Hardy is todays bond market.

Gerhardt (Gary) P. Herbert, Brandywine Global, Around the Curve, September 30 2019

|

Quote on

the Fly

|

Do the Germans have a problem with debt?

The German word Schuld has two meanings: debt and fault. This is something even those critics who do not know German (and often do not know much about Germany either) have learned. They believe that the homonym aptly describes the German obsession with debt.

Stefan Schneider, Deutsche Bank Research Management, August 30, 2019

|

Wars and Financial Panics: Global Bear Markets in the Twentieth Century

"The 1700s was a century of war during which there were five bear markets, each driven directly or indirectly by a European war. The 1800s, on the other hand, was a century of peace, with numerous panics, but only one global bear market which occurred in the 1840s. There were no global bear markets between 1848 and 1912, a 64-year stretch of peace and economic growth. War hit the world in 1914 when World War I began. Four bear markets occurred between 1912 and 1949. With the world generally at peace after World War II, recessions, sometimes driven by financial panics, were the main cause of bear markets." Read more...

Dr. Bryan Taylor, Global Financial Data, Aug 19, 2019

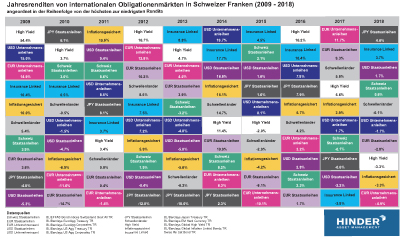

Yearly Returns of International Bond Markets in Swiss Francs (2009 - 2018)

Dr. Alex Hinder, Hinder Asset Management, 2019

|

Quote on

he Fly |

"In the theories I work with, there is always an equilibrium where no one chooses to hold the currency, and its value falls to zero. In this sense, currencies are fragile". (

) In the 1830s, 90% of the U.S. money supply was privately issued banknotes."

"...more than 2'600 cryptocurrencies have been launched. Nearly all of these remain today at the "zero value" equilibrium mentioned above."

James Bullard, Public and Private Currency Competition, Federal Reserve Bank of St. Louis, July 19, 2019

|

|

ECB: a critique of the critiques

We will examine here 12 critiques of the ECB to assess if they are fair, appropriate, consistent and if they offer superior alternatives to the ECBs current policy.

Read more...

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, 10 October 2019 |

Vanguard Balanced Index Fund Admiral Shares

Balanced Composite Index, 2019 Q3 YTD Returns

Vanguard, October 2019

Swiss Pension Fund Indices 2019 Q3 YTD Returns

Pictet LPP 2000 Indices

Pictet Asset Management SA, October 2019

Swiss Pension Funds 2019 Q3 Returns

Credit Suisse Pension Fund Index

Credit Suisse, October 2019

Mind over matter: How we react to an inverted yield curve is more important than the inversion itself

Determining whether an inverted yield curve signals a US or global recession continues to focus the minds of investors in 2019. Mark Robertson explains why our actions will matter more in determining whether a recession is on the horizon than what can be a misleading indicator.

Mark Robertson, Aviva Investors, 30 September 2019

Four Centuries of Stocks and Bonds in Retrospect

Financial markets have evolved over time. The relationship between stocks and bonds differed in each of the eras that Global Financial Data has designated in the past: Mercantilism (1602-1800), Free Trade (1800-1914), Regulation (1914-1981) and Globalization (1981-).

Dr. Brian Taylor, Global Financial Data, Aug 14 2019

|

Quote on

the Fly |

"The Euro will lead to too many houses in Spain, too many factories in Germany and too many civil servants in France, as each country will end up specializing on their comparative advantages."

Charles Gave, in his 2001 book Des Lions Menés Par des Anes.

|

Deconstructing Risk

"So, if the complexities are such and we lack the computing power to process even a fraction of what is needed to do the job, is all this just an exercise in futility?"

Altug Ulkumen, Lobnek Wealth Management, October 2019

|

Joe: "This is like the anti-ambitious story, it's like the anti-preparation story; super successful nevertheless!" Rob: "Yes, I guess the goal was just being vague with people."

Joe: "Be vague and look cool." Rob: "And act like you don't care!"

Joe Rogan Experience #1353 Rob Zombie, September 2019 |

A living artifact from the Dutch Golden Age:

Yales 367-year-old water bond still pays interest

Mike Cummings, Yale News, September 22, 2015

Gold Is Money. Everything Else Is credit.

"An expensive cash favors the rentier at the expense of the entrepreneur, and vice versa. The consequence is the emergence of a two-fold competition across major economic and monetary zones, on the cash side and on the equity risk side."

Didier Darcet, Gavekal Intelligence Software, The Quant Corner, September 2019

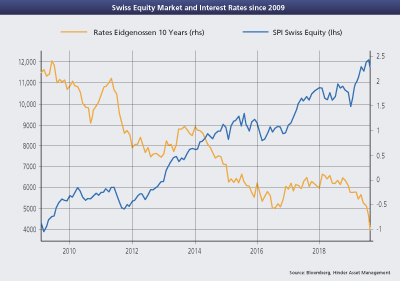

Swiss Equity Market and Interest Rates since 2009

Hinder Asset Management, Newsletter No 67, August 2019

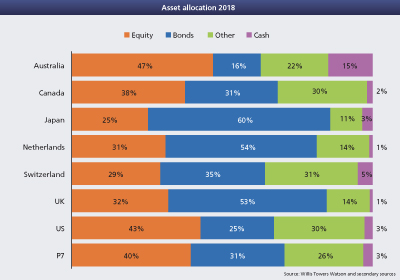

Pension Funds Asset Allocation 2018

Global Pension Assets Study, Willis Towers Watson, 2019

Domestic equity over total equity exposure

1998 - 2018

Global Pension Assets Study Willis Towers Watson, 2019

Domestic bonds over total bond exposure

1998 - 2018

Global Pension Assets Study Willis Towers Watson, 2019

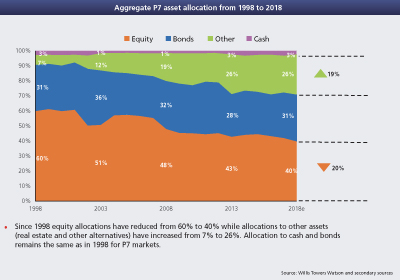

Aggregate P7 asset allocation from 1998 to 2018

Global Pension Assets Study, Willis Towers Watson, 2019

Thoughts on Yield Curve Inversion

Why an inverted yield curve isnt a hair trigger for stocks.

Luke Puetz, Fisher Investments MarketMinder, August 26, 2019

"I mean that that is the chracteristic of Wagner's men and women - the woman leads the way, the man rhapsodises."

Michael Tanner, Wagner, HarperCollins Publishers, 1996 |

Forecasting Current-Quarter U.S. Exports Using Satellite Data

Jun Nie and Amy Oksol, Federal Reserve Bank of Kansas City, Second Quarter 2018

Quick Hit: Digging Into US and European Returns

A look at recent market returns on a geographical basisand how sector weights may skew your view of them.

Fisher Investments MarketMinder, July 17, 2019

Time is running out to solve Chinas debt bubble

Many investors are focused on the outlook for trade talks with the US, fearing an all-out trade war which would negatively impact global, and especially Chinese, equity markets. But investors underestimate the mounting problems caused by the recent rapid expansion of credit in China. Only radical solutions now remain to resolve the countrys growing credit bubble.

Paul Smillie, Columbia Threadneedle Investments, July 2019

|

Arnold (on his wedding day): "The more I got into it the more nervous I got, it was an experience. But it was a lot of fun and I enjoyed it very much."

Johny: "I always had"

"One of those things you never forget!"

Arnold Schwarzenegger on Johny Carson, 1986 |

Inflation Expectations and Actual Inflation: 1998 - 2018

Chart excerpt from the article "Has the Anchoring of Inflation Expectations Changed in the United States during the Past Decade?"

Taeyoung Doh and Amy Oksol, Federal Reserve Bank of Kansas City, Economic Review, First Quarter 2018

Target Balances in the Euro zone

Cumulated German surplus with the rest of the Euro zone.

Charles Gave, Institut des Libertés, Et voila! LAllemagne va mal, July 1, 2019

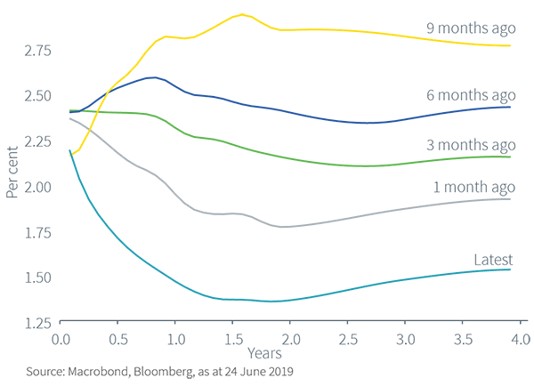

Market expectations for policy rates have shifted dramatically

FOMC policy expectations (OIS)

David Nowakowski, Aviva Investors, What our House View means for asset allocation and portfolio construction, July 2019

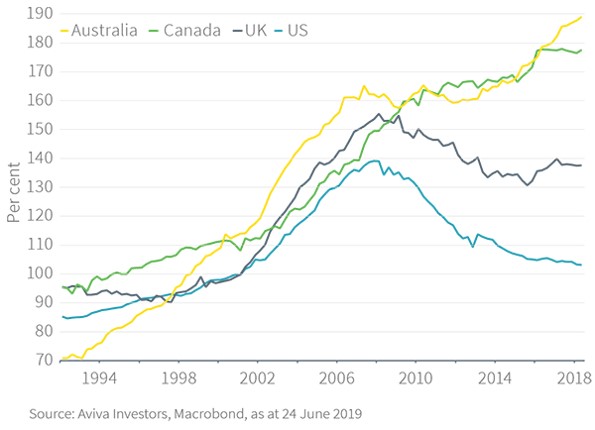

Not all households have reduced debt levels

Ratio of household debt to disposable income

Stewart Robertson, Aviva Investors, The five key themes and risks our House View team expect to drive financial markets, July 2019

|

Currency war, Donald Trumps next obsession

"Exchange rates and the economy influence one another in too many ways for any claim that the US foreign deficit stems from the overvalued dollar to be possible. But the US president and his advisors are unperturbed by subtleties of this kind."

Read more

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, 02 July 2019 |

The Future Of Everything

Lobnek Wealth Management, July 2019

|

"We actually explored the idea of doing a comedy film about Jesus, you know, with all the jokes about someone trying to book a table for twelve at the last supper."

Michael Palin, Monthy Python's Life of Brian - BBC Debate, 1979 |

The eurozones Japanification - more to come

With the eurozone economy stuck in a low growth, low inflation and low rates environment, it's really hard not to make 'Japanification' comparisons. If we're honest, the eurozone is probably already in the thick of it, which means rates are likely to remain lower for longer and every new crisis or recession will bring the bloc closer to more Japanification.

Carsten Brzeski, Inga Fechner, ING, 24th June 2019

|

Quote on

the Fly |

"It is also important to explore how central banks should use those unconventional policy tools in the future. In that regard, an interesting question is: will those unconventional policy tools become conventional policy tools in normal times?"

Haruhiko Kuroda, Opening Remarks at the 2019 BOJ IMES Conference Hosted by the Institute for Monetary and Economic Studies, Bank of Japan, May 29, 2019 |

The quest for uncorrelated returns. The fall (and rise?) of absolute return funds

The quest for uncorrelated returns can be an expensive pursuit, especially in terms of opportunity cost.

Stuart Canning, M&G Investments, Episode, 11 June 2019

|

Tough job that of a central banker

"Investors, bankers, economists, financial journalists, politicians, everyone has their own ideas about what monetary policy should be." Read more...

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, 4 June 2019 |

The Big Bang: Indexing Chinas Onshore Bond Market

"Bond portfolio inflows are likely to be a critical funding source for Chinas potential current account deficit, with both foreign private and reserve investors poised to raise exposure to Chinas onshore bond market. By changing the composition of some of the bond markets preeminent indices, there will be implications for bond investors, rates, and currencies."

Tracy Chen, Brandywine Global, Around the Curve, May 28 2019

Value Investing:

Bruised by 1000 Cuts

Rick Friedman, GMO Asset Allocation Insights, May 15 2019

Dont Speak Fedspeak

The Feds words are just thatnot actionsand its words are squishy. Two other words many Fed observers love to cite as gospel: data dependent. As in, the Feds monetary policy will be data dependent.

Fisher Investments MarketMinder, May 15, 2019

"But as you know, there is so many of our problems today where one side has monopolised the language, so heretical thoughts have become inexpressible; and this was beautifully caricatured by Orwell in 1984; but, you know, I was just reading an article in a French journal about the way in which Macrons speeches all conform to the syntax of 1984!" Roger Scruton

Douglas Murray and Roger Scruton on the future of Conservatism, May 10, 2019 |

The Federal Reserve Has an Inflation Problem

The Federal Reserve (Fed) has an inflation problem. The central bank is not generating enough of it. As a result, market and consumer inflation expectations are plumbing new lows.

Alberto J. Boquin, Brandywine Global, Around the Curve, May 6 2019

Inversion, aversion, perversion, reversion

"Seriously though if you look back at the very recent past we should have all been dead from Ebola, nuclear war should have broken out and Eurozone would have collapsed first thanks to Greece then because of Spain and Portugal and latterly because of Italy."

Peter Ahluwalia, Swisspartners, May 2019

|

Green Shoots With Deep Roots

The trajectory of fundamentals continues to surprise on the upside. Unlike others, we have been calling for global growth to reaccelerate after wobbling into the spring as a result of Chinas economic problems, the Feds uncertain direction, and President Trumps trade policies. Read more...

Michael J. Kelly, PineBridge Investments, May 2019 |

Investors and the French Revolution

"Few people realize how active the Paris stock market was during the 1700s. The Paris stock exchange was founded on September 24, 1724, though shares in the French East India Co. (Compagnie des Indes) had traded in Paris for years."

Dr. Brian Taylor, Global Financial Data, 17 April 2019

Reflections on the timelessness of happiness and the oddballs of life

"The link between time and happiness has always been something I found fascinating. Long before grasping the physics of time and space, I was lucky to be exposed to the idea that time represents a subjective state specifically associated with changes in mental stimuli."

Andrea Zazzarelli, Fathom Consulting, 3 May 2019

Payrolls Like GDP: Headlines Good, Underneath Really, Really Not

If the unemployment rate reaches zero and wages still dont explode higher, the economy falls off, will Economists, central bankers, and the media stop relying on this one statistic for overall economic interpretation?

Jeffrey P. Snider, Alhambra Investment Partners, May 3rd, 2019

Investors' Personality Influences Investment Decisions: Experimental Evidence on Extraversion and Neuroticism

"The authors find that extraversion and neuroticism significantly influence individuals' behavior in the experimental asset market."

Andreas Oehler, Stefan Wendt, Florian Wedlich & Matthias Horn, Journal of Behavioral Finance, Volume 19, 2018

750 Years of Interest Rates

"With these two charts, you can see how unusual the current decline in interest rates is, pushing yields down to levels that hadnt been reached during the past seven centuries."

Dr. Brian Taylor, Global Financial Data, 3 March 2019

Explaining the High P/E Ratios: The Message from the Gordon Model

Heinz Zimmermann, The Journal Of Investment Management, Vol. 16 No.4, 2018

The Market for Lemmings: The Herding Behavior of Pension Funds

"Using a unique dataset that covers United Kingdom defined-benefit pension fund asset allocations over the past 25 years, we present robust evidence that pension funds display strong herding behavior, and tend to herd in subgroups defined by fund size and sponsor type."

David Blake, Lucio Sarno, and Gabriele Zinna, Journal of Financial Markets, November 2017

|

"I made a certain amount of mistakes in my first marriage, like showing up..."

Woody Allen describes his ideal partner, The Dick Cavett Show, October 1970 |

Central Banks Are Messing with Your Head

By directly influencing peoples' valuation scales through the manipulation of market interest rates, central banks affect every aspect of peoples' lives. It amounts to a "Revaluation of all Values", to use a term coined by the German philosopher Frederick Nietzsche.

Thorsten Polleit, Mises Institute, 21/03/2019

Of wine, wine gums and debt

Brian Davidson, Fathom Consulting, 18 April 2019

The Forgotten Depression

1921: The Crash That Cured Itself

"In any case, to the best of my knowledge, no American policy-maker invoked the extraordinary events of 192021 as a potentially relevant precedent during the crisis of 2008; the collapse of 192933 rather monopolized the market in historical analogy."

James Grant, Simon & Schuster, November 17, 2015

The Coffee Chronicles

|

"I think the innovation that we are getting is driven in strange ways. I worry that the conformity problem is actually more acute than it was in the '50s or '60s, so that the category of the eccentric scientist, or even the eccentric professor is a species that is steadily going instinct because there is less space for that in our research universities than there used to be."

Peter Thiel, Conversation with Tyler, Mercatus Center, May 2017

Archetypes as Triggers of Financial Bubbles

"The author aims to demonstrate the workings of archetypes and proposes a measurement methodology designed to capture the subliminal forces that influence investment decisions."

Niklas Hageback, Journal of Behavioral Finance, Volume 18, 2017 |

|

Quote on

the Fly |

"We argue that yield-curve inversions are a signal that monetary policy is tight, and we show that tight policy has a substantially larger impact on the economy than easy policy. In other words, monetary policys brake pedal is more powerful than its gas pedal."

Inverted Yield Curve (Nearly Always) Signals Tight Monetary Policy, Rising Unemployment, Evan F. Koenig and Keith R. Phillips, Federal Reserve Bank of Dallas, February 12, 2019 |

Part 2: Our Evaluation of the Global Economic Cycle

The Bearish View of the Global Economic Cycle

Anujeet Sareen, Brandywine Global, Around the Curve, April 10 2019

Part 1: Our Evaluation of the Global Economic Cycle

The Bullish View of the Global Economic Cycle

Anujeet Sareen, Brandywine Global, Around the Curve, April 3 2019

10 Years of Slow Growth Fears

Growth slowdown fears appear omnipresent these days as investors worry this long global economic expansion is on the wane. But slowish growth isnt a bull market killeras stocks overall rise over the last decade attests.

Fisher Investments MarketMinder, March 25, 2019

I Get Knocked Down, Then I Get Knocked Down Again

When Will Value Investing Get Back Up?

Patrick S. Kaser, Brandywine Global, Around the Curve, March 25 2019

Japanese Banks Are CheapBut for Good Reason

Value investors are being tempted back into the sector, but problems remain.

Archibald Ciganer, T. Rowe Price, March 2019

Clash of Empires: Currencies and Power in a Multipolar World

Empires usually start off as road-building exercises. Which explains why, in Europe, everyone says that all roads lead to Rome. And when they dont build roads, empires build canals: the French built the Suez Canal (only to see the British buy Egypts stake once the hard work had been done), the Americans built the Panama Canal and, less happily, the Soviets built the Aral Sea Canals (which ended up triggering one of the greatest ecological disasters of all time).

Charles Gave & Louis-Vincent Gave, Gavekal, March 2019

Gold in Perspective

"There is no doubt that violating Federal Law and holding gold would have underperformed a diversified portfolio of stocks. However, the appropriate comparison is what cash, net of income tax, would have returned over this period. And here again calculating that is trickier than one might expect, because hundreds of banks failed in the 1930's and there was no FDIC insurance. And the Treasury didn't begin auctioning Tbills until 1929!"

Larry Williams, Rocky Humbert, Daily Speculations, March 6, 2019

|

|

"But his creative process is like almost engineered around being loose; like doing whatever he wants, going where he wants to go."

Joe Rogan Explains Dave Chappelle's Creative Process, JRE Clips, March 5, 2019

|

Chinas Gangbusters Loan Growth

China likes doing things on a grand scale; its recent stimulus is no exception.

Fisher Investments MarketMinder, March 4, 2019

|

Quote on

the Fly |

"Ce qu'il faut faire c'est le Bruxit, c'est sortir Bruxelles de l'Europe. Parce que l'Europe marchait très bien, jusqu'à Mr. Delors qui a décidé d'essayer de transformer l'Europe en une Nation, en un Etat."

Charles Gave, Le Peuple contre Bruxelles, Planetes360, March 13, 2019 | |

|

Global economy Winter Is Ending

"Other problems of secondary importance, or at least with more limited repercussions, could be added to this list, such as the crisis in the German automotive industry, the bout of social unrest in France, vain attacks by the Italian government on the Commission and, last but not least, the political psychodrama of Brexit."

Read more...

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, Economy & Rates, 12 March 2019 |

|

Quote on

the Fly |

"I think were actually on the cusp of something exhilarating and terrifying.

Paxman: Its just a tool though, isnt it ?

No its not. No its an alien life form (laughs). Is there life on mars ? Yes, its just landed here." Read more...

David Bowie speaks to Jeremy Paxman on BBC Newsnight, 1999 |

The Turkey

Remember Le Fevre's the "Turkey" in Reminiscences of a Stock Operator. The young guy told him, sell, take your profit. The Turkey says: "It's a bull market. I don't want to lose my position."

Jim Sogi, Daily Speculations, February 16, 2019

2018 U.S. Endowment Returns

"Data gathered from 802 U.S. colleges and universities for the 2018 NACUBO-TIAA Study of Endowments® (NTSE) show that participating institutions endowments returned an average of 8.2 percent (net of fees) for the 2018 fiscal year (July 1, 2017 June 30, 2018) compared with 12.2 percent for FY17."

NACUBO-TIAA Study of Endowments (NTSE), January 2019

|

Europe: make or break?

In a baseline scenario, our review of economic conditions and risks prompts us to pluck for the first answer: it will make it. In other words, we think there is a higher chance that the Eurozone economy will stabilise and recover in the months ahead than weaken further and fall into recession. Fear of an economic slump can have some virtues. Read more...

Bruno Cavalier, Fabien Bossy, ODDO BHF Corporates & Markets, Economy & Rates, 14 February 2019 |

The Broken Window Fallacy

"In 1850, the French economist Frederic Bastiat introduces the concept of opportunity cost with a fallacy in Chapter I of his book Ce quon voit et ce quon ne voit pas (What we see and what we dont see). In Bastiats tale, a mans son breaks a pane of glass, which ultimately stimulates the economy."

Didier Darcet, Gavekal Intelligence Software, The Quant Corner, February 2019

|

Quote on

the Fly

|

"The finance industry of 1900 was just as able as the finance industry of 2000 to produce bonds and stocks, and it was certainly doing it more cheaply."

Thomas Philippon, New York University, Finance vs. Wal-Mart: Why are Financial Services so Expensive? |

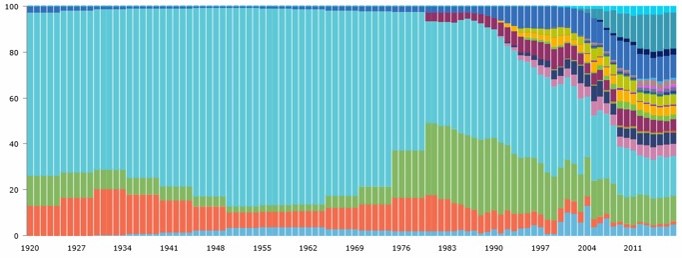

The Evolution of Swiss Institutional Investor Portfolios

1920 - 2017

Corestone Investment Managers, 2018

|

"Let us try for once not to be right."

Samuel Rosenstock, aka Tristan Tzara, a French-Romanian poet and essayist, "Data Manifesto", 1918, translated by Robert Motherwell, in "Dada Painters and Poets".

|

The Scandinavian Monetary Union of 1873

Together with the Latin Monetary Union of 1865, another example of a monetary union that didn't go quite as planned and ended before its 50th Birthday.

InvestmentOffice, February 2019

A Century of Chinese Stocks and Bonds

"London was the financial center of the world until World War II, and many companies in emerging markets listed their shares on the London Stock Exchange before a stock exchange even existed in that country. After World War I, many companies listed on the New York Stock Exchange."

Dr. Brian Taylor, Global Financial Data, 4 January 2019

Shallower Cycles?

"Less vigorous expansions spread over longer periods would entail a fundamental change in the risk/return dynamics of markets and a resulting shift in expectations."

Altug Ulkumen, Lobnek Wealth Management, February 2019

Events in Time Anniversaries: January 2019

25 years ago: January 1994

50 years ago: January 1969

100 years ago: January 1919

200 years ago: January 1819

300 years ago: January 1719

Dr. Brian Taylor, Global Financial Data, 22 January 2019

|

Quote on

the Fly |

"Bear in mind, without our money for the final 21 months of the current multi-annual financial framework, the EU is insolvent!

Now people say what plans have we made for no-deal; what plan has the EU made for no deal?"

Jacob Rees-Mogg on BBC, January 19 2019 |

Pyramid Distribution of US Equity Returns

S&P 500: 1825 - 2018

The Berenberg Capital Markets Outlook

Wealth and Asset Management

Berenberg, Horizon handout, January 2019

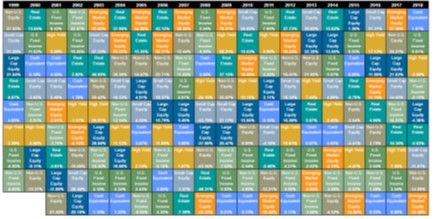

The Callan Periodic Table of Investment Returns 2019

Annual Returns for Key Indices Ranked in Order of Performance (19992018)

Callan Associates Inc., 2019

|

France: implications of the yellow vests movement

In a few short months, the yellow vests movement (gilets jaunes) has changed the way France is viewed in the economic and political spheres. The negative impact on the pace of activity seems modest, transient, limited to some sectors. On the contrary, the impact on the business climate and household confidence is extremely brutal. Read more...

Bruno Cavalier, ODDO BHF Corporates & Markets, 16 January 2019 |

|

Quote on

the Fly |

"The EU's "single market" is designed for goods. It works less well for services - which make up over 70% of the European economy."

The Economist, Big mistake, December 22nd 2018 - January 4th 2019 |

SYZ Macroeconomic Outlook 2019

Investment Perspectives

Fabrizio Quirighetti, Adrien Pichoud, Antonio Ruggeri, Michalis Ditsas, Roberto Magnatantini, Jöel Le Saux, Zhoaib Zafar, SYZ Group, January 2019

|

"I am not yet tir'd of doing nothing."

David Hume to Adam Smith, January 1766

|

|

Quote on

the Fly

|

"Therefore, we suggest that, unlike the 2007/08 Crisis which was more about a broken banking system involving the sudden collapse of leverage among over-extended banks and shadow banks, the current credit squeeze looks more like the 1997/98 Asian Crisis when Central Banks, led by the US Fed, tightened the supply of primary liquidity and cross-border flows rapidly retreated."

Michael Howell, Why has Global liquidity crashed again? CrossBorder Capital, January 2019

|

US Banks Havent Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this.

Jeffrey P. Snider, Alhambra Investment Partners, December 11, 2018

|

"Once again, these are just facts, and facts are never powerful enough vis-à-vis theories about war and what we want to believe."

Stephen Kotkins, Dartmouth, 1917 Centennial Series: War, Revolution, Socialism, War. October 2017 |

Economics Is Easy When You Dont Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Dont even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results.

Jeffrey P. Snider, Alhambra Investment Partners, December 7, 2018

|

Factor-based investing the third pillar

In our first white paper on factor-based fund management, we would like to give interested investors an insight into the history and current characteristics of this asset management approach. Read more...

Dr. Carsten Große-Knetter, Thierry Misamer, ODDO BHF Asset Management, November 2018 |

|

Faktorbasiertes Investieren als dritte Säule

In unserem ersten White Paper zum faktor-basierten Fondsmanagement möchten wir interessierten Anlegern einen Einblick geben in die Geschichte und aktuellen Merkmale dieses Ansatzes der Vermögensverwaltung. Weiterlesen

Dr. Carsten Große-Knetter, Thierry Misamer, ODDO BHF Asset Management, November 2018 |

Does the Yield Curve Really Forecast Recession ?

It's well known that in the United States recessions are often preceded by an inversion of the yield curve. Is there any economic rationale for this?

David Andolfatto, Andrew Spewak, Federal Reserve Bank of St. Louis, November 30th, 2018

Labor Force Participation Rates, 25-54 year old

A Strong Economy But We Can Aim Higher. Remarks by MARY C. DALY President and CEO Federal Reserve Bank of San Francisco To the Regional Economic Development for Eastern Idaho (REDI), November 12, 2018

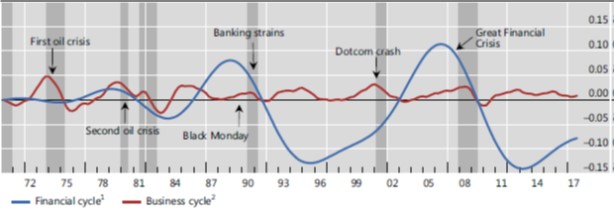

The financial and business cycles in the United States

"Put differently, calendar time might not be the best way to compare cycles over time."

Andrew Filardo, Marco Lombardi and Marek Raczko, BIS Working Papers, Measuring Financial Cycle Time, 7 November 2018

|

Quote on

the Fly |

"So when the majority of volume in the market is traded by people who do not care about fundamentals, what is that fundamentally mean for the stock market ? It is a pretty scary thought, right ?"

Brad Katsuyama, The Stock Market had become an Illusion, March 26, 2016 |

|

"I have several theories about things and stuff.

My theory about evolution: Darwin was adopted!"

Steven Wright, Wicker Chairs and Gravity, 1990 |

The history (and future) of inflation

It may not feel like it, but we live in inflationary times relative to long-term history.

Jim Reid, Craig Nicol, Nick Burns, Sahil Mahtani, Deutsche Bank, September 19, 2018

|

"All of the wealth creation can be attributed to the thousand top-performing stocks, while the remaining 96 percent of stocks collectively matched one-month T-bills."

Prof. Hendrik Bessembinder, Francis J. and Mary B. Labriola, Arizona State University, W. P. Carey School of Business, May 2018 |

The ECBs QE End Is Bullish

Closing the chapter on QE is bullishnot bearishfor investors, in our view.

Fisher Investments MarketMinder, November 8, 2018

Why French Investors are Truly les Misérables

"Over a 100-year period, French investors would have lost over 90% of their money after inflation no matter how they invested their money."

Dr. Brian Taylor, Global Financial Data, 17 April 2017

Can banks individually create money out of nothing? The theories and the empirical evidence

This study establishes for the first time empirically that banks individually create money out of nothing. The money supply is created as fairy dust produced by the banks individually, "out of thin air".

Richard A. Werner, International Review of Financial Analysis, December 2014

What do rising rates mean for international investments?

Brian Levitt, OFI Global Asset Management, October 11, 2018

Do we still believe interest rates will remain low for long?

Brian Levitt, OFI Global Asset Management, October 11, 2018

Notes on The Bitcoin Standard

"Bitcoin, as designed, is deflationary."

Michael Kendall, Man on the Margin, July 16, 2018

American Default

The Untold Story of FDR, the Supreme Court, and the Battle over Gold.

Sebastian Edwards, Princeton University Press, May 2018

|

In the depth of your ignorance, what is it that you want?"

Orson Welles getting frustrated with some studio personnel as he attempts to narrate some badly written commercials that he clearly finds quite annoying. Obscure Audio 2: Orson Welles Outtakes - Frozen Peas, 1970 |

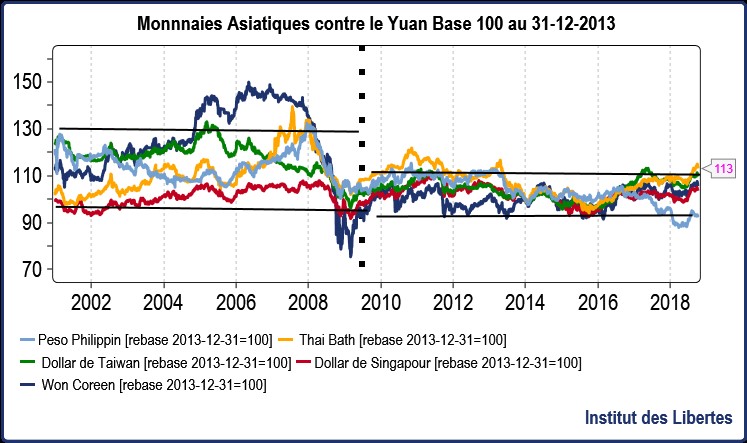

Asian currencies vs. Yuan, rebased at 100 on 31.12.2013

Charles Gave, Guerre Commerciale Chine/ Etats-Unis, Institut des Libertés, October 7 2018

Why Financial Institutions Struggle to Modernize

and Why They Have to

Prattle is pleased to publish this interview with Zac Sheffer, CEO and Founder of Elsen, focusing on the modernization of financial institutions and the future of data in finance.

Prattle, February 7, 2018

|

Quote on

the Fly |

Shadow Risk in Passive Investing

"The shift from active to passive investing is a significant amplifier of future volatility."

Read more...

Christopher Cole, Founder and CIO of Artemis Capital, Volatility and the Alchemy of Risk, Reflexivity in the Shadows of Black Monday 1987, October 2017 |

|